Skip to content

Consumer Products Conundrum 3

Back last December I highlighted a piece about the sorry state of innovation in the Consumer Packaged Goods (CPG) space. It was all about how the word “innovation” is overused when breathlessly announcing the introduction of peanut butter pop tarts or age defying skin creams.

The problem of innovation in CPG is, however, daunting.

In the majority of product categories, the innovation well has run dry. Most of the fundamental problems are solved. The tale of the tape is a long and accelerating decline in new intellectual property (i.e., patents).

Yet, as if to prop up the myth that innovation is the lifeblood of their enterprises, CPG companies have gone hyperactive with the churn of new items. This flood of new items (typically measured in unique “stock-keeping-units” or SKU’s) is relentless.

In nearly every product category I’ve looked at, the rate of annual new item introduction has increased 2 to 3 times in the last 20 years ago. But the novelty of these items and their measurable improvement in performance is becoming increasingly rare and hard to find.

What has emerged is a business model whereby the lifeblood of CPG is NOT innovation but churn.

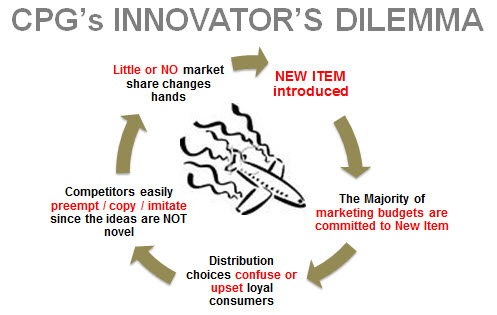

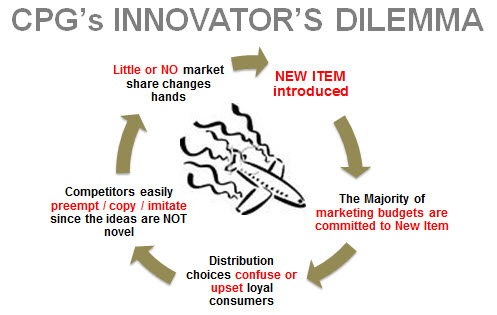

The problem is churn is expensive and it isn’t working. Big market share changes do not correlate to new item activity. They still rely on truly improved product experience (i.e., a product that really is better) or insightful new marketing messages that break through to consumers in unique and compelling ways.

But once on the churn train, CPG companies can’t get off. All of their operating activities, all of their marketing and selling, all of their budget and performance expectations, are tied up in spinning the new item wheel.

They’ve sold themselves to retail customers on the basis of delivering new items. Their brand equities are increasingly tied to their ability to generate “news.” Every brand’s message becomes: “We changed our product in some way you can’t notice, but trust us, it’s better! And because it’s new, we must be the better brand.”

Competitive advantage is fleeting. Distinctiveness and value starts to die. So along with the innovation well running low, relentless churn starts to suck the well dry on consumer trust and loyalty … the very essence of brand power.

What CPG firms are left with is a business model that starts to look like a death spiral.

Share This Story, Choose Your Platform!